The economic crisis that is gripping the banking sector and inter market credit markets, has polarized governments to establish an intervention problem beyond anything seen in the history of capitalism and global markets. As discussed numerous times on morbius glass this intervention is short sighted and dangerous for the future of market stability. So this economic crisis could have essentially burnt it’s self out albeit harshly, but that is the down side of capitalism; you play markets in boom times expect at some point a bust. That is the reality of markets. Still the belief that government intervention from fiscal stimulus to bank and company bailouts will work, has now developed into a frenetic hysteria of ‘bailouts’. Of course this will lead to the next crisis, or more correctly has exasperated the next crisis which in all retrospect could be worst than the credit markets imploding.

So with global economies and the markets still collapsing, the unsure aspect and volatility will continue to erode confidence. A widespread panic is developing again this could be the final drop in global markets, particularly stocks. But currencies are an excellent bellwether to it’s perspective economies.

The next crisis (and this could be sudden) could be accumulation of two things both leading into each other as a severe blow to a countries economic stability. The first is currency destruction, which is now happening on a broader economic front, as all countries have gone mad with stimulus packages and bailouts. A risky disposition under the false pretense that somehow countries will avoid a nasty bout of inflation down the line. We know this as untrue as inflation may not have entirely disappeared. Declines on discretionary items may have fallen dramatically, but I still hear and see increase in energy bills, food. Although containable at this point, it is not unfeasible to see a spike in food prices (depending on weather and climate change) and even oil (depending on the geopolitical volatility of the middle east and output shrinking/costs increasing).

When the UK recently decided to bail out RBS, claiming to 70% ownership of the company. The Great Britain Pound was immediately sold off, this was also on news the the UK government would insure credit worthy mortgages and guarantee bank debt. Not just for one bank, but for all banks. Hence the market factoring in that the UK government has now taken on huge risks, including the Bank of England’s terrible balance sheets which now rely on money printing to continue the flow into the UK economy. Not only does a falling pound represent the losing value of it’s worth, but the risk now of a country that may find it hard to raise capital; it’s government debt could be downgraded. As was Spain’s recently, also Portugal, Greece, Italy, Ukraine. Germany, France and the UK are close to be downgraded as credit worthy nations, in other words no one will want the debt.

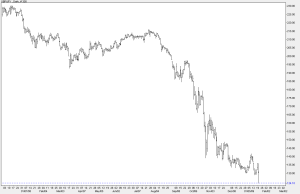

Refer to graph of the GBP against the Japanese Yen (From 1.41 7th January 2009, down to 1.24 on the 20th January 2009. The sell off was primary on news of the bank bailout out and government intervention into the UK banking system):

With Ireland recently threatening to pull out of the EU if it isn’t bailed out by the EU also effected EURO. The crisis is now in a panic phase, that extends not just from the credit/banking crisis; but politically. As politicians attempt to save their own necks, they are inevitably causing more harm to economic stability than good. It’s a ripple effect, that is becoming more an more pronounced. Disproportional and ‘ad hoc’ intervention is creating far more volatility and market panic, if they were to just allow the markets to correct itself naturally.

In saying that, the EURO was sold off dramatically when Standard and Poor down graded Spain’s sovereign debt, this is a warning shot to the FX markets; that European countries all could be downgraded in someway. With Ireland and Spain who are both extremely over leveraged especially in the property markets.

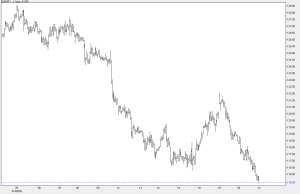

Refer to graph EURO against the Japanese Yen (from 131 18th December 2008 to 115 20th January 2009)

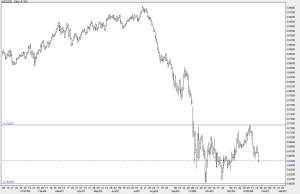

One of the better currencies (not in value) for measuring risk and volatility in the global markets is the Australian dollar. Once a favorite in carry trading, especially with Japanese FX traders. The AUD collapsed timed with the stock market collapse in September 2008 from .85 down to .60 in October 2008. Now bouncing around in a wide volatile range between .60 and .72, this would indicate the extreme volatility in the global markets. Although now the AUD is on the downside again, it could most probably breakthrough the .60 support. Especially if Australia gets a rating downgrade, or the Reserve Bank cuts rates aggressively in the coming months. Also to note is Australian government intervention in the banking sector of local credit markets. Other factors global too watch that will effect the AUD is the commodity markets, when or if a recovery occurs soon. Which may be unlikely in the short term.

refer to graph AUD/USD: