Archive for October, 2007

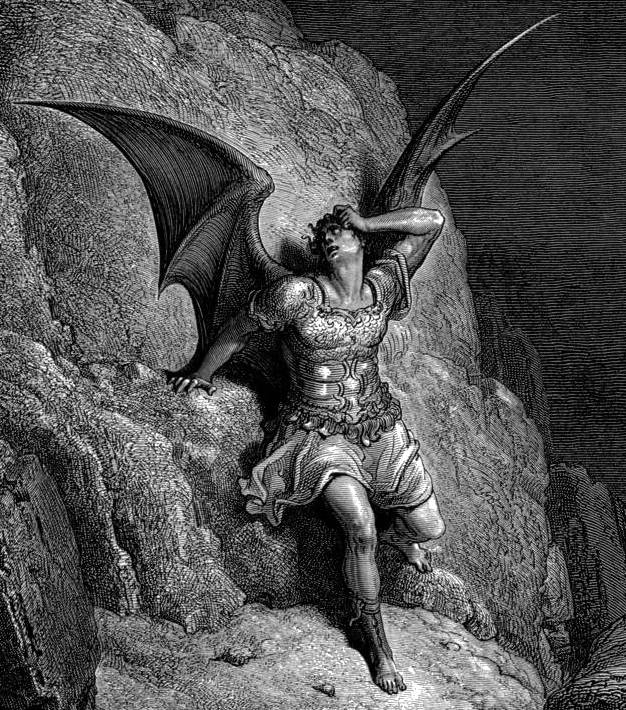

Gustave Dore’s – Lucifer

Posted by Adrian on October 31, 2007

Posted in Popular Culture/Culture | Leave a Comment »

World Crisis scenarios for the 21st century – Peak Oil. (update 6)

Posted by Adrian on October 29, 2007

Oil has now reached new highs of $93.00 + a barrel. A combination of a declining US dollar, geopolitical tensions between northern Iraq and Turkey and the ongoing tension between Iran and the US; over Iran’s Nuclear program. All contributing to an increase in oil prices, whether or not speculator based. The continued high oil price shows that oil, as a commodity, is becoming sought after and rare. Hence traders inflating the price, or adjusting the price to it’s correct high pricing. Will it continue upward? Yes, even regardless of geopolitical tensions. Oil is going to reach highs in price, never seen before in the history of humanity.

What sustained and escalated oil prices will do to oil dependant economies has yet to be tested, especially emerging economies like China and India.

World Crisis scenarios for the 21st century – Peak Oil. (update 6)

“The dollar fell before reports that economists forecast will show declines in housing prices and consumer confidence, bolstering speculation the Federal Reserve will cut borrowing costs this week. A lower dollar makes oil relatively cheaper in the countries using other currencies.

Tensions between Turkey and Iraq over Kurdish militants as well as over Iran’s nuclear program are helping drive oil prices higher. Iran and Iraq hold the world’s second- and third-biggest crude oil reserves, after Saudi Arabia, according to BP Plc.” Bloomberg – Worldwide

Posted in Finance and Economics. Strategy and Society | Leave a Comment »

“Prometheus Unbound” – (Percy Bysshe Shelley)

Posted by Adrian on October 26, 2007

“To suffer woes which Hope thinks infinite;To forgive wrongs darker than death or night;

To defy Power, which seems omnipotent;

To love, and bear; to hope till Hope creates

From its own wreck the thing it contemplates;

Neither to change, nor falter, nor repent;

This, like thy glory, Titan, is to be

Good, great and joyous, beautiful and free;

This is alone Life, Joy, Empire, and Victory.”

Posted in Popular Culture/Culture | Leave a Comment »

Art Deco, Victorian Buildings – Melbourne City, Australia. (1)

Posted by Adrian on October 25, 2007

The old Shamrock pub, now residential, is located in one of Melbourne’s oldest suburbs, Port Melbourne. A once very working class area connected to the Port areas of Melbourne City.

Most of the buildings in Port Melbourne were built in the early to mid 1900’s, some date back to the 1800’s, these buildings range from small ‘worker’s cottages’, to old churches, pubs, schools. The area is no longer working class, although remnants still remain. It has become a trendy area, probably overvalued as far as house prices, with small weather board worker’s cottages selling for more than $500,00.00 +! Most of the houses in the area are generally very small houses, that have retained the same size since they were built in the early 1900’s!. So thankfully development in Port Melbourne has been kept to a minimum. It is a charming area, with history of the old Melbourne City intact.

Posted in Melbourne City Urban Visuals. Mixed images | 3 Comments »

Australia entering into hyperinflation? CPI figures released October 2007, core inflation 16 yr high.

Posted by Adrian on October 24, 2007

As expected by the Australian CPI figures, prices grew significantly higher in the 3rd quarter at a 0.7 % up 1.2% in the last 3mths. Up an overall 1.9%.

The weighted-median inflation measure an inflation gauge that the RBA measure from, in simple terms the ‘core’ measure that measures everyday consumer prices, has risen to 0.9%, a percent higher than what economist/markets were expecting which was a 0.8% rise. The core inflation is the measure for food, clothes, utility costs, rental, housing mortgages which are all now heavily inflated.

Slight offsets from falling fuel and child care rebates in the last quarter, but hardly any effect on the inflation figure of 0.9%. With fuel and food costs set to rise in the coming months inflation will become more serious for the Australian economy. Could Australian enter hyperinflation? Possibly. Prices are are climbing dramatically upward, lead by food, fuel and housing.

I expect a 95% chance that the RBA will increases rates in November by 25 basis points (0.25%), bringing the cash rate to 6.75% from 6.50%. If inflation is not contained, we will see interest rates hike again early next year. If the RBA pauses and decides not to increase rates in November 2007, there will be a dramatically spike upward in consumer prices which will lead to a hyper-inflated economy.

But Australia, like Europe and the rest of Asia are currently in the midst of higher food, oil inflation, Bloomberg.com – Australia’s inflation

“ Annual inflation in Europe in September exceeded the European Central Bank’s 2 percent ceiling for the first time in more than a year. China’s annual inflation rate surged to a 10-year high of 6.5 percent in August.

French annual inflation accelerated to 1.6 percent last month. Singapore’s consumer prices rose 2.7 percent from a year earlier, close to the strongest increase in more than 12 years.

“Prepare yourselves for some serious inflation in your cost of living, because globally we are seeing pricing power starting to return to farmers,” Futuris’s Wozniczka said.

Posted in Finance and Economics. Strategy and Society | 2 Comments »

World Crisis scenarios for the 21st century – Nuclear War (update 4)

Posted by Adrian on October 24, 2007

“The president said if “rogue states” had less confidence their missiles would strike, they would be “less likely to engage in acts of aggression in the first place”.

The myth of the ‘rogue states’ is getting played again by President Bush. The missile shield being deployed in Europe is a dangerous and provocative measure aimed at the reemerging super power Russia.

Posted in Finance and Economics. Strategy and Society | 1 Comment »

“El cazador trofeo de los hombres”

Posted by Adrian on October 23, 2007

Posted in Melbourne City Urban Visuals. Mixed images | Leave a Comment »

Art Deco, Victorian Buildings – Melbourne City, Australia

Posted by Adrian on October 23, 2007

Moorish inspired Art Deco building – suburb: Elwood, an inner city bay area. Melbourne City. Click on image for larger scale

Posted in Melbourne City Urban Visuals. Mixed images | Leave a Comment »

Reserve Bank Of Australia interest rates may rise in Novemeber 2007

Posted by Adrian on October 22, 2007

The CPI is due out on the 24th October Wednesday 2007, a very good chance the CPI will indicate high consumption and high price inflation. Inflation in Australia is becoming like a run away train. Housing affordability is at an all time low, rent, food, fuel and general living expenses are all rising. Unemployment is low, so generally there is overall high inflation in the Australian economy.

The RBA will lift interest rates in November 2007.

Posted in Finance and Economics. Strategy and Society | Leave a Comment »

World Crisis scenarios for the 21st century – Peak Oil. (update 5)

Posted by Adrian on October 19, 2007

World Crisis scenarios for the 21st century – Peak Oil. (update 5)

Oil is now trading close to $90.00 per barrel in Asian trading, although the high price is not indicative of Peak Oil per se, what is indicative with the current high price of oil and Peak Oil is the vulnerability of the oil markets; as far as geopolitical tension or conflict combined and the supply shortage of oil worldwide.

The current high prices for oil is the anticipated incursion into northern Iraq by Turkish troops to hunt down PKK (Kurdish fighters based in the northern mountain ranges of Iraq). If a full scale attack does take place we will sees oil in the mid $90.00.

As discussed on morbius glass regarding the global economic situation. High oil, inflated European/Asian currencies, reemerging global credit crisis and a severe recession about to hit the US is developing into a serious issue globally. The G7 meetings will do nothing regarding the high Euro, although the US may cut rates again in end of October to try and stave off a recession.

In my opinion the central banks including the ECB, BoE and US Federal Reserve are going to lose control of the world economy and markets very quickly.

Market Watch ASIA MARKETS Stocks decline as crude oil hits record high

Posted in Finance and Economics. Strategy and Society | Leave a Comment »