Australia’s economic situation.

Posted by Adrian on March 23, 2009

After more than a decade of uninterrupted economic growth Australia is now in recession and with the help of government fiscal irresponsibility, it will be a deep one.

Governments in Australia enjoy giving millions of dollars to the tax payer sans appropriate social security and public health care. It’s vote grabbing initiative that the former conservative government embarked on with a terrible decision to give out a ‘baby bonus’ to couples, now the centre left goverment has guaranteed a severe deficit by throwing billions at the public in the form of first home owner grants. Australia’s revenue almost solely relies on a continuous export market of raw materials to China. Of course with China in recession the commodity markets have slumped, more so base metals and coal exports. Which makes up for 57% of Australia’s exports and Australia’s GDP got crunched in January 2009; from 1.80% at the end of 2008 to the current 0.3% (Jan 2009). But the centre left goverment in Australia also has decided to bail out the car industry and under written bank debt and guaranteed bank deposits. As local Australian banks raise capital selling their goverment protected debt onto the market, this puts pressure and risk on Australia’s sovereign fund. Which in term will eventually be downgraded as risky assets on the the funds balance sheet grows. This in turn will make it almost impossible for Australia to sell short and long term goverment bonds onto the market. Combining the inability to raise capital and a possible credit downgrade of goverment funds, governments may have no choice but to raise taxes on everything. As the main revenue driver for government accounts was the GST (General Services Tax) tax. Already land tax (commercial property) is now being passed onto tenants of offices buildings, as local goverment try and reverse their deficits. This land tax being passed from landlords onto tenants of office buildings is at a time when office vacancies ate increasing at an alarming rate (due to the recession). Increased taxes on private business will ensure that job losses will mount.

Regarding GDP and Australia’s reliance of raw material exports, it could be a distinct possibility that the Australian mining sector could collapse, from junior miners to medium size miners all will have their profits squeezed as the Australian dollar becomes depressed and demand slumps from Asia. The mining sector and goverment were both winners when the Australia dollar was at an all time high and demand was strong from Asia, this of course has changed dramatically with the Aussie losing 35% since July 2008 and the global economy falling off the cliff mid last year. A strong AUD is unlikely in the short and long term as long as goverments are content at going to ground zero with interest rates and printing money, which in retrospective is a form of currency protectionism. As goverments then fall into major trade surpluses with swelling inventories. Australia may be no different, a cheaper currency could allow exports to pick up in mining but unfortunately profits also will shrink with a collapsing currency. A lower Australian dollar will not be viable for companies to survive especially in a recession environment. Also deflation in global currencies will ensure competition (deflationary) against other commodity producing countries to try and secure their export markets, minus their import markets. As discussed in Global currencies devaluing – protectionism end games, this is an alarming stage in protectionism on trade.

But as the Australia dollar is sold off and money supply increases plus a trade surplus expands, imports will be more expensive, exasperating a pullback in import purchases thus widening the recession. Inflation on imported goods will occur and goods become more expensive due to a collapsing dollar. But like Spain (now falling into a deep recession), Australia has an extremely over leveraged housing market and rental bubble. Due mainly to goverment cash incentives (grants) to buy property a housing bubble has ensured second to Spain’s and worst than the US housing bubble prior to the collapse.

Australia’s stock market and currency are good indicators of investors fears about the Australian economy; both the stock market and currency may slump further as the Australia economy falls deeper into a recession in 2009.

ALL ORDS (one year):

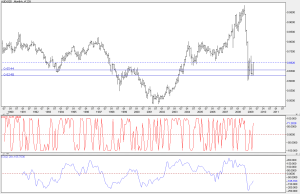

AUD/USD (note recent artificial rally of the AUD, due to the USD weakness, watch for Australian rate cuts and money expansion into 2009):

Australia could go bankrupt in 2009 « morbius glass said

[…] by Adrian on March 25, 2009 Further to my post Australia’s economic situation. The AAA rating has been stripped from local governments as the Federal government guaranteed banks […]

Nick said

Give the government a break!!! – Kevin did well and i am a huge liberal fan

izmir söve said

izmir söve…

[…]Australia’s economic situation. « morbius glass[…]…

iphone game said

iphone game…

[…]Australia’s economic situation. « morbius glass[…]…

trabalhe para si com o part-time-internet said

trabalhe para si com o part-time-internet…

[…]Australia’s economic situation. « morbius glass[…]…

rent a car izmir said

rent a car izmir…

[…]Australia’s economic situation. « morbius glass[…]…

Elvis said

I actually wanted to share this unique posting, “Australia�s economic situation.

� morbius glass” with my close friends on fb.

I reallyonly sought to pass on ur very good publishing!

Many thanks, Herbert

Charlotte Photographer said

Thanks to my father who stated to me regarding this web site, this webpage is in fact amazing.

povia said

As you develop your mad wallpapering skills you will ad contrast,

style, connectivitly and a perfect design to your dollhouse

kit, if it is not limited by space or direction. These theories are very good for use with a mouse and how much more control with sampling as you practice.

austria vienna said

I’ve been surfing online more than 2 hours today, yet I never found any interesting article like yours. It’s pretty worth enough

for me. In my view, if all website owners and bloggers made good content as you did,

the internet will be a lot more useful than ever before.

http://ansarwasif.com//index.php?p=1266 said

Thanks for the auspicious writeup. It in truth used to be a leisure

account it. Glance complex to far delivered agreeable from you!

By the way, how could we keep in touch?

comparador de apuestas said

Logró su mejor clasificación en la temporada

1998/99 (2º) y su peor clasificación en las temporadas 1985/86 y 1989/90 (20º).

grupointegraconsultores.com said

What’s up to all, it’s in fact a nice for me to visit this

web site, it includes priceless Information.

ford mustang said

ford mustang

Australia’s economic situation. « morbius glass