Ok, my post here was essentially a caffeine (yes caffeine) induced conversation with a friend who trades in the market. Basically we were amazed (as was everybody) as US taxpayers paid AIG executives bonuses, although not entirely surprised. We tried to imagine the possibility of the US government reversing it’s ‘bailout everybody’ policies; to protect it’s own wealth (taxpayers monies). So it is a fantasy. Nothing more. The reality is that the US (with other countries already beginning the process) is now on a mission to destroy it’s currency. This quantitative easing (printing money) and buying up mortgage back securities and any other securities tied to the credit markets, is essentially a massive attempt at flooding the USA and world with cash. Courtesy of the Federal Reserve under a self confessed money printer Ben Bernanke.

This is of course will lead to inflation even in deflationary environments, but the other factor is the protectionist aspect as all global currencies are been devalued at the same time. So it could be wise to assume that a huge debasement in global currencies and their value is the first shot in a protectionist agenda.

As the US attempts to self capitalize, outflows of investment from USD and USD related assets will occur. Today I listened to an economist at a certain big bank explaining the benefits of the massive money printing exercises by the Federal Reserve, but again he missed the point that inflation will trump any internal inflows of cash into the US economy (hey like Zimbabwe!). But as discussed with all the global Central Banks attempting to do the same as the Federal Reserve like the Bank of Japan and Bank of England; by collapsing their currencies they will of course force import prices up. So it’s a terrible situation for the global economy. But expected.

So, from a trading perspective it’s time to look at inflation protective buys. Obliviously gold, oil and the few currencies that still show a degree of value, at this point the Japanese Yen although I would say short term. Stocks, such as bigger oil refinery and produces, some bigger mining companies. Pharmaceuticals, although debased currencies will kill the import market on drugs (hence effecting company profits) although depending if there is crisis such as a severe flu out break. Or watch for tariffs removed for flu drugs. Some ETF’s, say long term purchases on Japaneses stocks. Still if you trading short term, ETF’s on silver, index put warrants on all major indices. Short US banks.

The USD/YEN – notice the USD about to punch through 93 Yen support, then it will reside in the trading range of 83-92:

Oil:

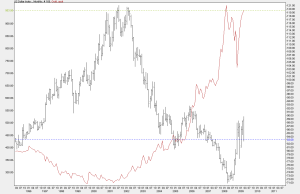

Gold against the USD (self explanatory):