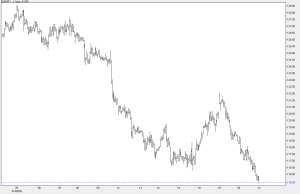

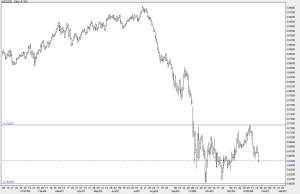

Even though 2008 will close off as a terrible year for the global economy, 2009 will turn out to be horrendous. As liquidity will literally dry up right across the board, the only money being pumped into the economy will come directly from the Central Banks. Not only will growth completely slump in 2009, there will be three aspects (bailing out banks, printing money, increased taxes/cuts to public spending – health and community) to economies which have a devastating effect on a society. With governments throwing billions into the financial system, that on the whole will end up creating zombie companies and propping up zombie banks. As mentioned in ‘Keynesian’ fiscal policy out of control – Australian government bond downgrades, the worst policy plunders a government can make is cushioning the banking system, that has operated in a incompetent and risky way. In other words, the banks or at least the banking model should be punished for it’s lack of care and bad management. This hasn’t happened, instead they have propped up the bad business models. There are going to be lasting effects of tax payer money going straight into buying distressed debt, toxic waste, MBS’s and every bad assets banks own; and don’t believe these ‘effects’ will be a positive for the global economy. Shifting ledgers and accounts by using government money and guarantees, has given banks the ability to recapitalizes their balance sheets, whilst shifting their depreciating assets into other ledgers. So not only has tax payer money being used to recapitalizes banks balance sheets ( but don’t expect to receive personal big credit/loan account offers ), governments have foolishly rushed into guaranteeing bank deposits, with guarantee caps going up to a million plus, the banks can now also re capitalize by selling secured debt or bonds that are now AAA rated. But governments who are now sending all their accounts into deficit, will find it hard to raise capital because government debt will naturally be downgraded, 1. from all the risk on their balance sheets, 2. bank debt is now more attractive to investors, compared to government debt.

Still, the final insult to injury will be governments finding it hard to raise capital; which will be left with the taxpayer again (us), in the raising of taxes and the cutting of public spending – especially health and social services. Nice deal hey?

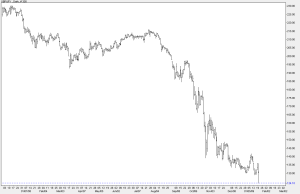

Then the money printing, which will ensure that inflation will creep back, especially in the US as the US dollar declines rapidly into 2009.

Another example of poor judgment and mindless money printing and spending by government has been the car industry bailouts. Most probably some of the worst business models known to humanity are now all knocking on government doors. You can thank the worst government policy machine in the world which is American policy makers, who have no idea whats going on and their incumbent central bank (The Federal Reserve) which is literally out of control. So it’s a double whammy of economic stupidly.

The car industry will still shrink, despite bailouts and loans, but as mentioned the US have created a precedence; now Canada, Russia, the UK and even France are all considering doing the same. At some point jobs losses in the car industry will be inevitable, but with governments only pumping money into the ailing car industry for their own self interest, ie votes. The joke will be back on the poor car workers as profits will still tumble and the fact is jobs cuts (company restructuring) have already been planned by upper management.

With emotion aside, one has to be sensible at the ramifications of printing money into a severally hemorrhaging car industry. It is senseless, sure the governments can print money, but this will lead to currency destruction and inflation, with the other detriment being raised taxes and public funding cuts. The pain, should be felt now, deal with it . The upper management should be relinquished, company then goes bankrupt and taken over by a rival; say a Japanese based car company (that made better smaller cars).

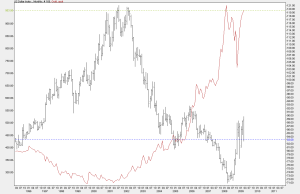

Also on a analytically perspective. The oil price has crashed from highs of 147 to 38 a barrel, it could go lower. Over leveraged and hugely indebted car giants took massive gambles, with car production. Designing fuel guzzlers and uneconomical junk (refer to the Chrysler 300c). I wouldn’t invest a dollar into that industry, with the oil price totally unstable in lower ranges, indicates that the world economy is slowing down to crunch time. Industries are using less fuel, oil and any petroleum based products. These industries have also expanded on loose credit conditions, are all going to find it hard to raise capital. As a trader, you just need to bring up the oil graph and see the massive deflation in the oil price; with potential to go much lower. But with oil trading in a range at 40 and 43 a barrel indicates that demand has fallen off, therefore any oil related products or products that use oil (cars) have also fallen off. In other worlds, there is NO MONEY to be made in collapsing industries, like the car industry. Yet, the governments have decided to create yet another living dead industry.

Refer to WTI graph. Oil looks stabilized to a point: trading range 40, 43. This could be on the back of OPEC cuts. From a bull to bear perspective on the oil price, which has been a shock in the sense of much it has fallen. Points to the direction of the global economy, which is sharply down. At this point the oil price does not look like it’s in a recovery buy at any point at all. Some more selling into 2009 on economic factors could see the oil price bounce down to 35 a barrel